Based on the recognition that corporate governance functioning effectively is indispensable for a company to remain competitive and efficient, and thus to maximize the return on investment for our shareholders, INNOTECH pursues fair and sound management in line with the global standards.

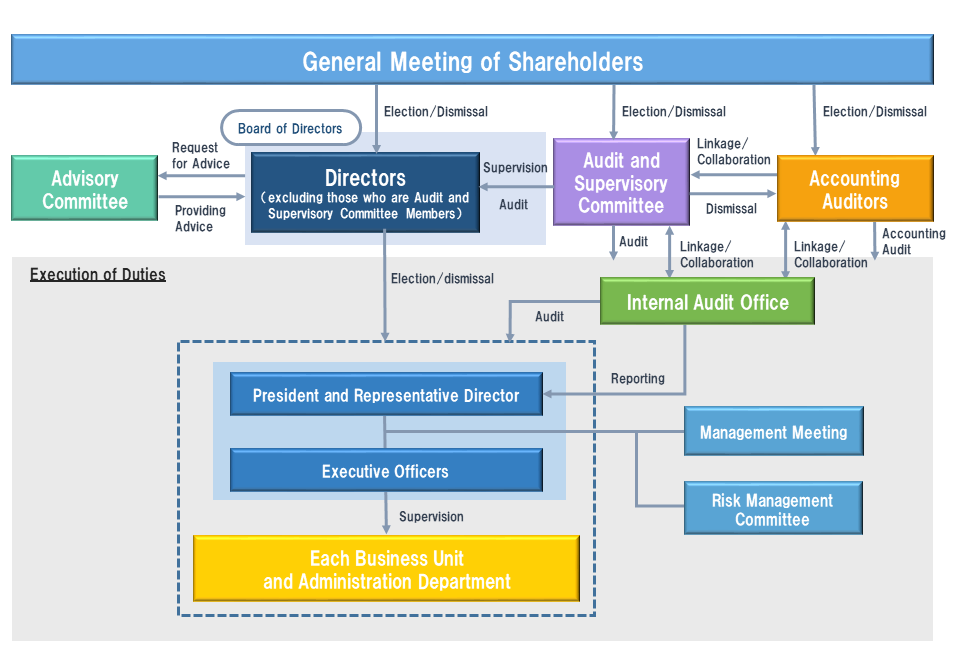

Overview of INNOTECH Corporate Governance Scheme

INNOTECH transferred from a company with the Audit & Supervisory Board to a company with the Audit & Supervisory Committee on June 23, 2023 by the resolution of the 37th Annual General Meeting of Shareholders held on the same date to partially amend the Articles of Incorporation.

The objectives of this transfer were that (i) by adding the Audit & Supervisory Committee Members, who are in charge of audit of execution of duties by Directors, to the members of the Board of Directors, INNOTECH believes that it can reinforce the supervisory function of the Board of Directors and further strengthen its monitoring mechanism, thus enhance the quality of its corporate governance, (ii) by enabling the Board of Directors to delegate the decision making on a wide range of important business operations to the designated Director, the supervisory functions of management and execution of business are segregated, the speed of managerial decision-making is accelerated, and its corporate value will become higher.

In addition, INNOTECH has adopted the Executive Officer System to reinforce execution of business and improve its corporate governance by the resolution of the 37th Annual General Meeting of Shareholders to partially amend the Articles of Incorporation to establish such system. INNOTECH has 5 Directors (one of them is a female director) who are appointed and in order to clarify the responsibility and flexibly to cope with the changes of the management environment, their term of service is one year (the term of Directors who are Audit & Supervisory Committee Members is two years). Majority of the members, who are 3 out of 5, are Outside Directors. The Board Members are, Nobuyuki Otsuka as the President and Representative Director, Yoshinori Tanahashi as the Senior Managing Executive Officer and Representative Director, Ichiro Anjo as the chairman of the Board of Directors, and Kimito Nakae and Shino Hirose who are Outside Directors. 3 Audit & Supervisory Committee Members (one of them is a female member) are appointed at INNOTECH and by having three of them from outside the company, INNOTECH believes that audits are conducted independently enough. The Audit & Supervisory Committee Members are Outside Directors, Kimito Nakae (Chairman), Ichiro Anjo and Shino Hirose.

The Advisory Committee whose majority of members consist of the Independent Outside Directors is established as a voluntary advisory body to the Board of Directors to provide advice and recommendations with respect to election and dismissal of Directors and Executive Officers and remuneration of such Directors and Executive Officers, thus strengthens the independence, objectiveness and the accountability of the function of the Board of Directors. The members of the Advisory Committee are the Independent Outside Directors Shino Hirose (Chairperson), Ichiro Anjo, Kimito Nakae, and the President and Representative Director Nobuyuki Otsuka.

Below is the chart showing INNOTECH corporate governance scheme and how it functions;

Reason for Adopting the Relevant Corporate Governance Scheme

INNOTECH has adopted the current corporate governance scheme since June 23, 2023 with a belief that it will enhance the quality of its corporate governance and increase its corporate value as the company accelerates the speed of decision-making and execution of work by delegating authority of the Board of Directors to Directors and reinforce the supervisory function on management through exercising voting right at the Board Meetings by the Audit & Supervisory Committee Members, who are in charge of audit of execution of duties by Directors.

Outside Officers

As of June 25, 2024, the number of Outside Directors at INNOTECH is 3, and all of them are Audit & Supervisory Committee Members. None of these Outside Directors have any special interest relationship with the company.

Outside Director Ichiro Anjo supervises and provides effective advices from an independent perspective to improve management and administration of the Company by taking advantage of his many years of experience and deep insight in the semiconductor business. Ichiro Anjo is a president of Jisso Partners, Inc. INNOTECH believes there is no special interest with them.

Outside Director Kimito Nakae has many years of experience and specialist expertise in the administrative organizations and the financial industry, and therefore is assigned as an Outside Director, with the expectation that he is able to supervise and provide effective advices from a broad range of view to improve management and administration of the Company.

Kimito Nakae is the Outside Auditor of Daiwa Securities Co., Ltd. INNOTECH has IR-related transactions with the parent company of Daiwa Securities Co., Ltd., which is Daiwa Securities Group, Inc. However, the transaction amount is insignificant and therefore, INNOTECH believes that there is no materiality that would create a special relationship from the standpoint of the company’s sales volume. Also, Kimito Nakae concurrently holds a post of the Auditor at the Tokyo Foundation For Policy Research, which is a public interest incorporated foundation, and INNOTECH has no special relationship with the Foundation.

In addition to a wealth of experience in the areas of corporate law and compliance as an attorney, Outside Director Shino Hirose has a broad range of expertise in international businesses and corporate activities. Therefore, she is assigned as an Outside Director, with the expectation that such highly-specialized experience and perspectives are utilized in the overall management of the Company.

Shino Hirose is a partner of Abe/Ikubo/Katayama Law Office and works for other organizations. INNOTECH believes there is no special interest with such parties.

INNOTECH determines that Outside Directors are independent when they do not contradict with any of the requirements with respect to Outside Directors provided by the Companies Act of Japan, independence criteria provided by the Tokyo Stock Exchange, as well as any of the following items provided by INNOTECH;

・He or she is the shareholder with more than 10 % of voting rights of INNOTECH or its group companies, or has experience in working in such shareholders’ organization.

・He or she has experience in working at major business counterparts, major lenders, or lead managing security companies of INNOTECH or its group companies in the past 5 business years (“A major business counterpart” shall mean a company whose transaction amount with INNOTECH or its group companies exceeds more than 2 % of the consolidated annual sales amount of INNOTECH, its group companies, or such company. “A major lender” shall mean a company whose loan amount to INNOTECH or its group companies is more than 2% of the consolidated total assets of INNOTECH, its group companies, or such company).

・He or she has received a large sum of legal counsel fee, auditing fee, consulting fee or alike from INNOTECH or its group companies in the past 5 business years other than the Corporate Officers’ remuneration from INNOTECH or its group companies or has experience in working in such company which received such a large sum of fees (“a large sum” means annual 50 million yen or more).

・He or she belongs to an entity which received more than a certain cumulative amount of financial contribution from INNOTECH or its group companies (“a certain cumulative amount” shall mean 20 million yen or more).

・He or she has the second-degree familial relation or closer with those or is a relative who lives together with those defined in the above items.

・He or she has served as Director of INNOTECH for longer than a period of 10 years in aggregate.

The Company, based on the provisions of the Tokyo Stock Exchange, has reported Ichiro Anjo, Kimito Nakae, and Shino Hirose as independent officers.

Linkage among the supervision by Outside Directors and the internal audits, audits by the Audit & Supervisory Committee and the accounting audits, and relationship with the Internal Control Department

All 3 Outside Directors are the members of the Audit & Supervisory Committee. Outside Directors regularly meet to exchange opinions and information with the Internal Audit Office and the Accounting Auditors, or attend audits as necessary, in order to improve the reliability of financial reporting. In addition, Outside Directors regularly receive reporting on the operation status of internal control at the Board Meeting to share and understand relevant information.

INNOTECH has started its analysis and evaluation on the Effectiveness of the Board of Directors and continues to disclose such analysis and evaluation results since FY2015 (ending March 2016). During FY2023 (ending March 2024), INNOTECH conducted self-evaluation on the Effectiveness of the Board of Directors with all the Directors and the Audit & Supervisory Board Members as follows. This fiscal year, INNOTECH outsourced the creation and distribution of the questionnaire to a third party in order to obtain new objective viewpoints.

Method of evaluation

Items of the Questionnaire

Major items of the FY2023 Questionnaire on the Effectiveness of the Board of Directors are as follow. Each item was evaluated by five grades and a respondent could provide comments freely as well. These items were adjusted, keeping consistency with the items from the year before, so that the questions will be relevant to the current issues of the company.

Improvement Status of the Problems Identified the Year Before

The Board of Directors and the Secretariat took following measures in FY2023, based on the results of the FY2022 Evaluation on the Effectiveness of the Board of Directors.

・Institutional Design and Identifying Items to be Discussed at the Board Meetings

INNOTECH has transferred to a company with an Audit & Supervisory Committee on June 2023. As a result, the supervisory function and execution of business are segregated, and the roles of Outside Directors are defined. Also, the supervisory function of the Board of Directors was reinforced by limiting and streamlining the items to be discussed at the Board Meetings to material management matters.

・Establishment of Election Criteria for Directors including Outside Directors

INNOTECH has created a skills matrix chart which summarizes necessary skills for the Board of Directors for each area. Then. It was indicated which Director (candidate) has expertise in which area in the Notice of the Annual General Meeting of Shareholders.

・Establishment of Hiring and Training Policies for Employees

INNOTECH has established the Education Committee and devised the hiring and training policies for employees. Desirable qualities of candidates are defined in the hiring policy and the information is disclosed on its website. As for training, employees went through an exam to analyze their business skills, to identify skills to be strengthened, and received relevant training more than twice a year. As for management training and succession planning, the Human Resources Development Committee was established and the committee engages in activities, making potential assessments and so on.

・Reexamination of Method for Evaluation on the Effectiveness of the Board of Directors

INNOTECH introduced a new evaluation method mentioned above in the “Method of Evaluation” section.

Evaluation Results of FY2023

After the analysis and the discussions on the results of the FY2023 Evaluation on the Effectiveness of the Board of Directors, the following content was confirmed;

・Through the entire survey, there was no negative evaluation. We confirmed that the Board Meetings generally keeps their effectiveness.

・As to the Institutional Design and Structure of the Board of Directors, it was the first survey after the transfer to a company with an Audit & Supervisory Committee, and the evaluation results were generally good. Especially, quality of discussion was improved because the roles of Outside Directors became clearer.

・As to Election of Directors, the newly-disclosed skills matrix was also highly evaluated. But there were some comments that continued discussions would be necessary.

・As to the Operation Scheme of the Board, the results showed that the training programs for Directors on business knowledge are more requested by Directors than the training programs on general subjects, such as corporate governance.

・As to the Discussions at the Board Meetings, the results showed that Outside Directors were willing to discuss and get involved with matters related to hiring and training of employees.

・As to the Deliberation on the Management Plan and the Management Policy, it was indicated that while various topics were covered, there were still some other points which need to be examined.

・As to the Performance Evaluation for the Management Team, Monitoring and Feedback, the evaluation results were generally good and there was no particular request nor opinion.

・As a result of cross-sectional analysis on whether the PDCA cycle was functioning at workflow (each process) of the Board Meetings, no weakness was identified on any particular element.

・No major issues were found due to the change in evaluation method, but there were some concrete opinions and requests provided by the Board.

Future Issues

・INNOTECH will continue to improve the evaluation method, such as by utilizing the third-party evaluation agency.

・Currently, the Board Meetings are operating in a highly satisfying manner and it was pointed out that that they should not become a formality. As fs for some topics which did not surface during regular discussions for matters related to Human Capital Management and on business execution, as well as subjects which were never put on a table such as R&D-related topics, Outside Directors mentioned that they wish to have some more information and opportunities to learn about the business. The items to be discussed at the Board Meetings will be reviewed on a continued basis.

Matters related to the Policy to Determine Amount or Calculation Method of the Officers’ Remuneration

INNOTECH resolved the company policy to determine the content of individual compensations of the Directors at the Board Meeting. Prior to the resolution, the Board of Directors consulted with the Advisory Committee, which was established as a voluntary advisory body to the Board of Directors, whose majority of members consist of the Independent Outside Directors and whose commissioner is one of the Independent Outside Directors. The Advisory Committee advised the Board of Directors that the policy was appropriate.

The policy is as follows;

Basic Policy

Remuneration paid to the Directors consists of “Monthly Compensation” as fixed compensation, “Performance-based Compensation” which is linked to short-term business performance, and “Restricted Stock Compensation” as mid-term and long-term incentives. Remuneration for Outside Directors and Directors who are Audit & Supervisory Committee Members, is “Monthly Compensation” only, taking their role to supervise and provide advices on management into consideration.

| Form of Compensation | Content of Remuneration |

|---|---|

| Fixed Compensation (Monthly Compensation) |

Paid to all Directors to compensate their duty to supervise management and execute business affairs, taking each Director’s position and role into account. |

| Performance-based Compensation |

Bonus paid to Directors (excluding Outside Directors and Directors who are Audit & Supervisory Committee Members) and Executive Officers based on the Company’s consolidated business results, and payment is made if and when each fiscal year’s target of the Net Income Attributable to Owners of the Parent is achieved. Payment amount depends on its excess target rate. The reason to adopt the Net Income Attributable to Owners of the Parent as a profit target is that INNOTECH believes it is an important management index which directly contributes to enhancements of corporate value and shareholder returns. The maximum amount is 300% of the total Monthly Compensation of Directors and Executive Officers to be paid. The distribution for each Directors and Executive Officers is determined after taking the contribution level of each business area where he is in charge to the consolidated operating profit, achievement level of the original business plan made in the beginning of the fiscal year for the said business area, results of ESG/SDGs-related activities, and his position and duty into account. As for an indicator of the performance evaluation, INNOTECH believes that the consolidated operating income is an appropriate indicator since they are responsible for the company’s business performance. |

| Restricted Stock Compensation | Offered in order to give Directors (excluding Outside Directors and Directors who are Audit & Supervisory Committee Members) incentives to sustainably enhance the corporate value of INNOTECH Group and to have them share a profit-based awareness from the perspective of stockholders. The maximum number of stocks offered to all Directors is determined, utilizing the consolidated ROE and PBR of the consolidated fiscal year before as indicators on a fifty-fifty basis. Afterwards, the number of stocks offered to each Director is determined within the above scope, evaluating each Director’s mid-term and long-term contributions to enhance corporate value. |

The Advisory Committee deliberates the appropriateness and the fairness of total remuneration amount and individual compensation amount of “Monthly Compensation” and “Restricted Stock Compensation” paid to Directors including the President and Representative Director (excluding Outside Directors and Directors who are Audit & Supervisory Committee Members, hereinafter the same shall apply), based on the resolution made by the General Meeting of Shareholders as well as the standards prescribed by the “Corporate Officers’ Remuneration Rules” and the performance evaluation, and reports to the Board of Directors. Based on the report from the Advisory Committee, the Board of Directors determines the individual compensation amount.

For “Performance-based Compensation” paid to Directors including the President and Representative Director and Executive Officers, the Board of Directors resolved the maximum total payment amount and that the individual compensation amount would be up to the sole discretion of the President and Representative Director, Nobuyuki Otsuka. The authority delegated to the President and Representative Director was to evaluate and distribute Performance-based Compensation paid to each Director, taking contribution level of each business area where he is in charge to the consolidated operating profit, achievement level of the original business plan made in the beginning of the fiscal year for the said business area, results of ESG/SDGs-related activities, and his position and duty into account. The reason why such authority was delegated to the President and Representative Director was that he was considered to be the best person to evaluate the business area where each Director and Executive Officer is in charge, overlooking the performance of the entire INNOTECH Group. The Advisory Committee deliberates the appropriateness and the fairness of individual compensation amount of “Performance-based Compensation” paid to Directors and Executive Officers including the President and Representative Director, based on the resolution made by the General Meeting of Shareholders as well as the standards prescribed by the “Corporate Officers’ Remuneration Rules” and the performance evaluation, and reports to the President and Representative Director. Based on the report from the Advisory Committee, the President and Representative Director determines the individual compensation amount under his authority which is delegated by the Board of Directors.

As for determining the content of individual compensations of the Directors, since the Advisory Committee reviewed the draft proposal from various aspects, including its consistency with the relevant company policy, the Board of Directors has decided to respect the report presented by the Advisory Committee and to follow the relevant company policy in principle. The number of Directors at INNOTECH Corporation is prescribed as 5 or less in its articles of incorporation and the remuneration amount of Directors (excluding Directors who are Audit & Supervisory Committee Members) was resolved as 300 million yen or less on an annual basis at the 37th Annual General Meeting of Shareholders held on June 23, 2023 (the amount does not include the employee-portion salary for a Director who also holds an employee post at the Company). Also, at the 37th Annual General Meeting of Shareholders held on June 23, 2023, separately from the said maximum amount of the remuneration, it was resolved that the Directors (excluding Outside Directors and Directors who are Audit & Supervisory Committee Members) may receive 150 million yen or less of compensation by Restricted Stocks on an annual basis.

Remuneration amount of Directors who are Audit & Supervisory Committee Members was resolved as 60 million yen or less on an annual basis at the 37th Annual General Meeting of Shareholders held on June 23, 2023. The number of Directors (excluding Directors who are Audit & Supervisory Committee Members) is 2, and the number of Directors who are Audit & Supervisory Committee Members is 3 (the number of Outside Directors is 3) at the 37th Annual General Meeting of Shareholders held on June 23, 2023.

| Category of Officers | Total Remuneration Amount (Unit: 1000 yen) |

Total Remuneration Amount by Remuneration Type | Number of Officers | |||

|---|---|---|---|---|---|---|

| Fixed Compensation | Performance-based Compensation | Restricted Stock Compensation | Retirement Bonus | |||

| Directors (excluding Outside Directors and Directors who are Audit & Supervisory Committee Members) |

148,962 | 125,043 | − | 23,919 | − | 5 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

3,300 | 3,300 | − | − | − | 1 |

| Outside Officers | 28,500 | 28,500 | − | − | − | 6 |

| FY2023 Target | FY2023 Actual | |

|---|---|---|

| Consolidated Operating Profit | 3,000 million yen | 2,474 million yen |

| Profit Attributable to Owners of Parent | 2,000 million yen | 1,477 million yen |